TL;DR – Labour MP Zainal Sapari calls for Grab to be “transparent and not change the rules according to their whims and fancies.”

We first read about how Ms Atikah Ahzamshah, a food delivery rider with Grab, took a cash advance of $1,380 from Grab to buy a return air ticket to Milan in a Straits Times article. Ms Atikah had requested an advance of about $1,470. A 6.5 per cent admin fee was immediately deducted. She is repaying the sum at the rate of $57 a week for 26 weeks.

Ms Atikah is just one of the the many Grab partners (that’s how Grab refers to its Grab drivers and riders) who has been offered the option of taking up an advance, which Grab refers to as “not a loan”, but an “early payment of future driver incentives for a one-time admin fee”.

Here’s the Skinny on Grab’s Upfront Cash Scheme

Grab offers an Upfront Cash Programme that lets selected drivers and food delivery partners an option to take a cash advance on their future earnings, and pay it back in weekly instalments.

Here’s how the Grab Upfront Cash scheme works at a glance:

- Drivers/food delivery partners selected will be offered a maximum amount that they can apply for.

- This amount is based on factors such as one’s individual historical earnings and overall earning pattern.

- While there is no interest charged, a one-time administration fee which is derived from a variable percentage of the advance taken up will be charged when applied.

- Administrative fee can go up to about 8%.

- According to information on Grab’s website, applicants can choose to repay the advance over a maximum of 52 weeks. However, all the Grab drivers and riders we spoke to indicated that they were offered a duration of up to 26 weeks for repayment.

- A fixed deduction will be made from the applicant’s earned incentives via their Cash Wallet every Monday until the Upfront Cash balance is fully repaid.

The Good

The Grab Upfront Cash scheme can be a good source of financial help, or even a lifeline, to some people.

With limited financing options for lower-income and also for self-employed people who may have problem furnishing proof of income, it’s not a surprise that many would find Grab’s Upfront Cash an easily accessible way of getting a loan.

So for people like Ms Atikah, the Grab Upfront Cash scheme can be a good avenue to tap into fast cash to either check off a holiday off a bucket list, to pay for a big ticket item, or to help a family member.

“This kind of micro loans very important for people with not much savings”

We spoke to 45-year-old Grab driver-partner, Mr Goh whose Grab earnings is about $1,500 per week and he was offered $5,000 advance. He took up the $5,000 advance due to personal reasons. He’d shared, “It is not difficult to repay. Just continue driving lor. Sure can repay.”

Mr Goh thinks that it’s a good product that Grab is offering. “It is a good thing. Instead of illegal moneylender or going to the bank with tedious application, so troublesome. This is a lot easier. Lower rejection rate also, since Grab only offers to pre-selected drivers. It is a fantastic thing that Grab offers this. Maybe children need things for studies, school trip, or even if family sick. This kind of micro loans very important for people with not much savings.”

“I took up the Grab Upfront Cash three times.”

We also spoke with 52-year-old Mr A (who prefers to remain anonymous), who has been a full-time Grab driver for three years. He has been offered the Grab Upfront Cash scheme three times and he took it up all three times. The amounts offered were different each time possibly due to the fact that his earnings fluctuated, but the amounts offered ranged from $5,000 to $10,000.

Mr A’s first cash advance was $7,500 and he had used it to clear part of his credit card debt. His second and third advance amounts were $5,000 and $5,300 respectively, and he had used the money to improve the family’s lifestyle.

Mr A supports the Upfront Cash scheme as he sees it as a good outlet for drivers with sudden cashflow needs. For full-time drivers who plan to continue to drive, he sees no big problem so long as they can remain committed to the job and be prepared to commit for 26 weeks or whatever the repayment period is. “Must commit, be prepared for 26 weeks. Dont ownself chut pattern. If you are committed to drive full-time, everyone can repay the advance. So far, no issue.”

“We all go into this scheme willingly, with our eyes wide open. You know what you’re getting in. So don’t make it sound like Grab forced you to take the advance.”

“I see it as a form of welfare from Grab”

Other than Grab drivers, we also spoke to Mr Lim, 36 and single and he is a Grabfood delivery rider. He currently earns about $1,200 a month, and has not been offered the Upfront Cash scheme by Grab. However, he thinks that “the scheme can be something useful.” If offered, he would consider it very seriously and use the advance to buy a Power-Assisted Bicycle (PAB).

“This cash advance scheme is a lot to do with self-control. I see it as a form of welfare from Grab. Nobody forces you to take it and to overspend. There are some companies that provide salary advance for their staff and to also to tie them down. It is not uncommon.”

The Bad

Offering easy access of cash advance to vulnerable groups of people who might find it challenging to find alternative work and to people with little financial literacy and planning can be bad.

There are good reasons for the legislation to regulate money lending. To put it simply, the rules and the law are to prevent unscrupulous lenders from abusing borrowers, especially the more financially ignorant and vulnerable ones, and also to prevent irresponsible borrowers from over-stretching themselves.

A somewhat related point is how advances are usually granted by companies to employees. But in this case, these Grab drivers and food delivery partners are freelancers and not exactly employees of Grab. However, what Grab is doing now is akin to them acting like employers but without the responsibility of one.

What happens if they take up the cash advance, and then something happens that result in them not being able to continue with the Grab driver or food delivery partner jobs? After all, they are not employees of Grab and Grab does not have any legal obligation to take care of them like employees.

For instance, a Grab driver might run into an accident that results in him or her not being able to drive for a period of time? Or what about a change of law like the recent ban of PMDs on footpaths that affected the food delivery riders’ income?

A portion of Grab drivers and food delivery riders belong to the lower-educated, lower-skilled and even vulnerable groups. These are potentially people who would find it challenging to land alternative jobs that can pay as much, and what if they’re further burdened by the weekly repayments from taking up the cash advance?

What if they have taken up the cash advance for non-essential items or spending when they are better off not spending that money? The easy access of fash cash dangling in front of them is too much of a temptation; what if they lack self-discipline and just take and spend the money just because it’s easy access?

“My two friends took the cash advance and went gambling”

We spoke to Mr B (who prefers to remain anonymous), a Grab driver and he shared that he earns about $600 weekly and has been offered $1,500 under the Upfront Cash scheme. He did not take it since he did not need it as “I don’t want to get locked in by Grab with the weekly repayments when I’m just a part-time driver.”

He does not think well of the scheme. “Instead of positioning it as a loan, Grab markets it like those fancy credit lines from banks. I receive the notification said something like, ‘Want to buy the big ticket item you always wanted?’ and they keep planting all these ideas in your head to go get it.”

“My two friends took the cash advance and went gambling.” We asked if it ended well for his friends, and Mr B said they lost the money through gambling, but had no problem paying back the advance in weekly instalments.”

“What if the trip fares drop even more? Then we’ll all be stuck”

Mr Chua, 39, is a part-time food delivery rider. He is aware of the Upfront Cash scheme, but has not been selected for an advance. He shared that he is also not interested.

“I think the admin charge of 8% is quite high. My friends and I are the older group of riders, so most of us already have unsecured credit facilities with bank or we have our own savings. It doesn’t make sense for us to pay admin fee for advance of our future earnings.”

“The cash advance will probably be appealing to those younger riders who don’t have strong financial literacy and need quick cash. But once you have this cash advance with Grab, what happens if you default on your payments? And who knows? what if later the trip fare drop even more? How are the riders going to pay back the cash advance?”

The Ugly

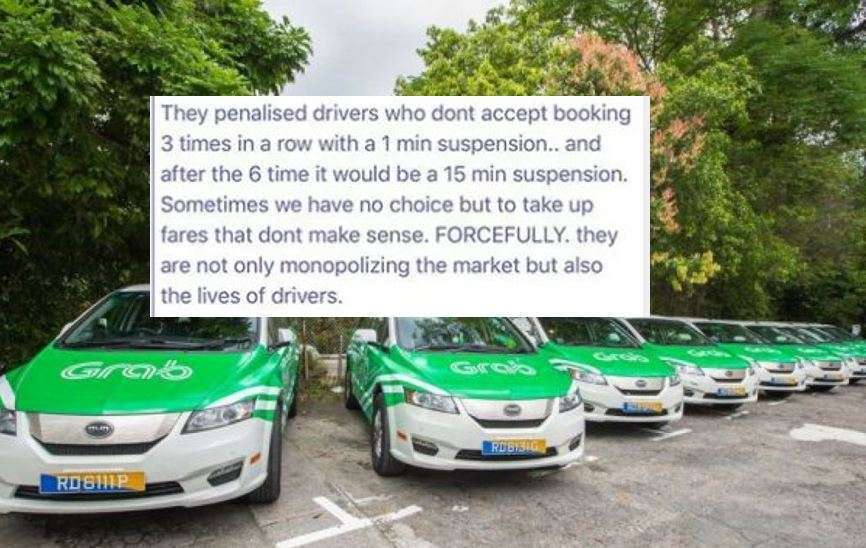

Labour MP who is also NTUC’s Assistant Secretary-General Zainal Sapari shared an email that a Grab driver sent him after Straits Times published the article about the Upfront Cash scheme.

Here’s a screenshot of the driver’s email in full.

Labour MP Zainal reminded drivers and riders to exercise caution,

“While this scheme can be useful to the borrowers in need of immediate cash assistance (compared to borrowing from loan sharks), borrowers must still beware of the risks involved because their future earnings can fluctuate. GRAB claimed that they will be selective and provide assistance to those who may run into difficulty in servicing their loans. I hope the penalties or interest for late payments are not severe to the point of causing the original loan to balloon out of control like those offered by money lenders.”

Labour MP Zainal summed it up well. He hopes that Grab is not a “modern slave master using digital as a cover”, and we need Grab to be “transparent and not change the rules according to their whims and fancies.”

“I agree that the GRAB driver has a choice but, I am surprise that you do not think this is a cause for concern. In giving the loan, GRAB is charging an admin fee of up to 8% (GRAB wins). When a driver takes a loan with GRAB, they lower the incentives unilaterally and saves cost and makes it harder for the drivers to earn good income. (GRAB wins). Because the loans are offered to their good drivers, GRAB is able to retain these workers and by manipulating the incentive schemes, these workers have to work longer because of less incentives (GRAB wins) again.”

“Should we blame `external party’ – my answer is yes if they are not transparent and change the rules according to their whims and fancies. That is why I am worried because someone texted me and opined that GRAB is akin to a `modern slave master using digital as cover’.”

(Featured image via)

Click here for the full, original article,

Is Grab a modern slave master using digital as a cover?

The Dive is our new weekend feature where we bring you in-depth news, interesting insights and different perspectives on the latest trends or issues that matter.